CLOs at a glance

ABS of Corporate Loans: A Collateralised Loan Obligation is a structured credit product built upon a portfolio of leveraged loans (senior secured loans to Private-Equity owned corporates)

Similar features to other ABS products

Key statistics at a glance

Global CLO Volumes ($bn)

Realized losses on CLO tranches have been substantially less than other ABS asset classes over the last 29 years

Why are CLOs attractive?

High Volume: Since 2013 there has been >$80bn of primary issuance each year (see opposite). After mortgages, it is the largest asset class in the ABS space

Diverse product range: High number of primary issuers in US & Europe

Principal Protection: CLOs have many of the same structural enhancements seen in ABS products (OC tests, senior note protection)

Low defaults: Moody’s report zero realised losses over the past 29 years, on a 10 year cumulative basis, for senior notes, with <1% recorded at the Baa (BBB eq) level (see 2nd chart). This compares favourably to all other ABS products across the US & EMEA

High Yielding: Given the specialist, non-retail & high margin nature of the underlying collateral (c. SOFR+500bps today), the rated notes pay a higher yield compared to other ABS products

Liquidity: Strong & sustained secondary market activity in senior notes through recent stressed events (Ukraine / Silicon Valley Bank), supported by multiple trading desks in London & New York

Recommended insights

Understanding CLOs

Welcome to our series of memos on CLOs, to help un-mask some of the mystery behind this high performance credit product. Over this series we aim to cover:

Learn More

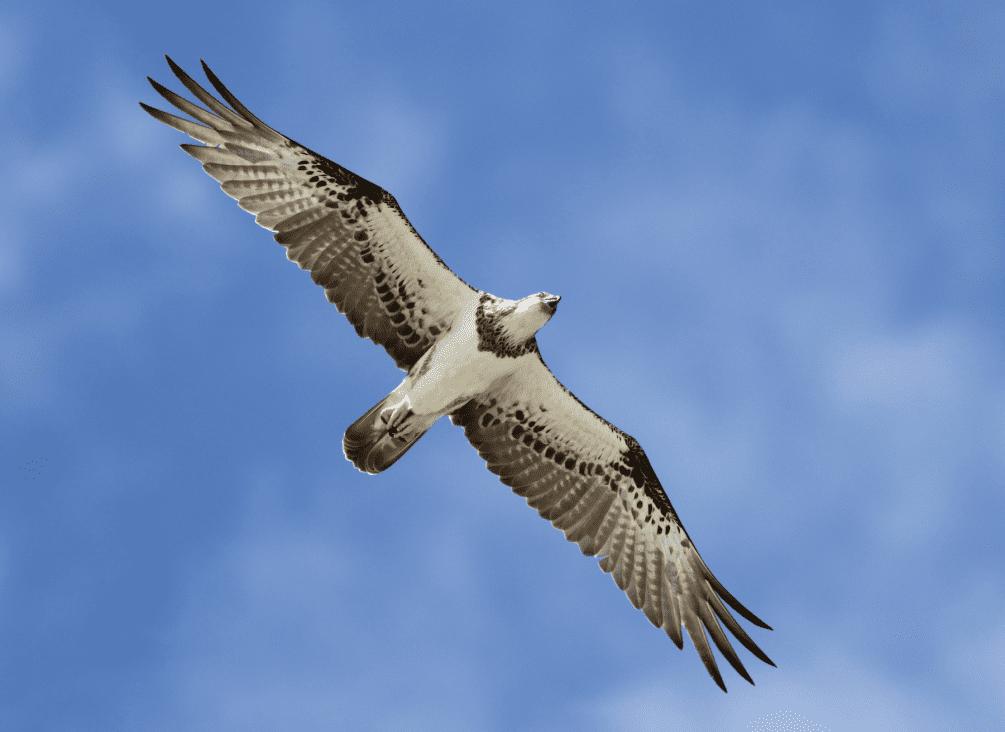

Osprey Total Return

Osprey is the first actively-managed, on-chain portfolio designed to offer returns that that aims to generate a target return above SOFR for loan providers.

Learn More