ABS / CLO markets Dynamics

Risk and Value Drivers

Interest Rates, Inflation and Macroeconomic Environment

These are the biggest issues facing the ABS sector in 2023. Not only does uncertainty regarding the direction of interest rates tend to affect origination volume but it can also impact duration (a floating rate instrument is more likely to be repaid early should interest rates start to reduce). The wider macroeconomic environment can also drive up delinquencies and defaults across portfolios of retail assets (car loans, mortgages), impacting net returns.

Geographical Divergence

As the West emerges from COVID, each economy resumes normalcy at varying speeds, influenced by unique national issues, such as political transition, public health, trade dynamics and unemployment rates. For example: In the United Kingdom, while navigating the initial years post-Brexit, there are encouraging signs of economic resilience. Notably, the automotive industry has witnessed a resurgence in production—a significant milestone following the pandemic. In contrast, Germany and the Euro-zone find themselves officially in recession, raising concerns about elevated unemployment rates and the broader economic repercussions across these regions.

New Issuance Down

A combination of macro-economic factors, including higher inflation & interest rates has seen lower primary loan & consequently CLO issuance in 2023. Although current levels do suggest activity close to 2019 levels, the last ‘normal‘ year pre-COVID (2021 & 2022 being largely catch up, post pandemic levels of activity)

Global CLO Volumes ($bn)

Sector / Product Trends

Flight to Quality: Shift towards Prime over Sub-prime assets post-COVID

Sectors such as cars and credit cards, characterized by shorter durations, have displayed remarkable resilience since 2020

The Commercial Mortgage market has seen significant change leading to widespread concerns about the Commercial Mortgage-Backed Securities (CMBS) market, with minimal to no resulting issuance

Residential Mortgages have sustained a higher issuance level although below the recent peak of 2021, following the COVID rebound. Political support for households across different geographies has helped protect the residential mortgage sector from larger defaults

Leveraged Loans have demonstrated robust performance, even amidst slight upticks in default rates in 2023. Underlying performance has been stronger in 2023 than predicted, and well-run leveraged buy-outs appear to be performing to a level that preserves value in at least the senior debt tranches

Recommended insights

CLOs at a glance

ABS of Corporate Loans: A Collateralised Loan Obligation is a structured credit product built upon a portfolio of leveraged loans (senior secured loans to Private-Equity owned corporates)

Learn More

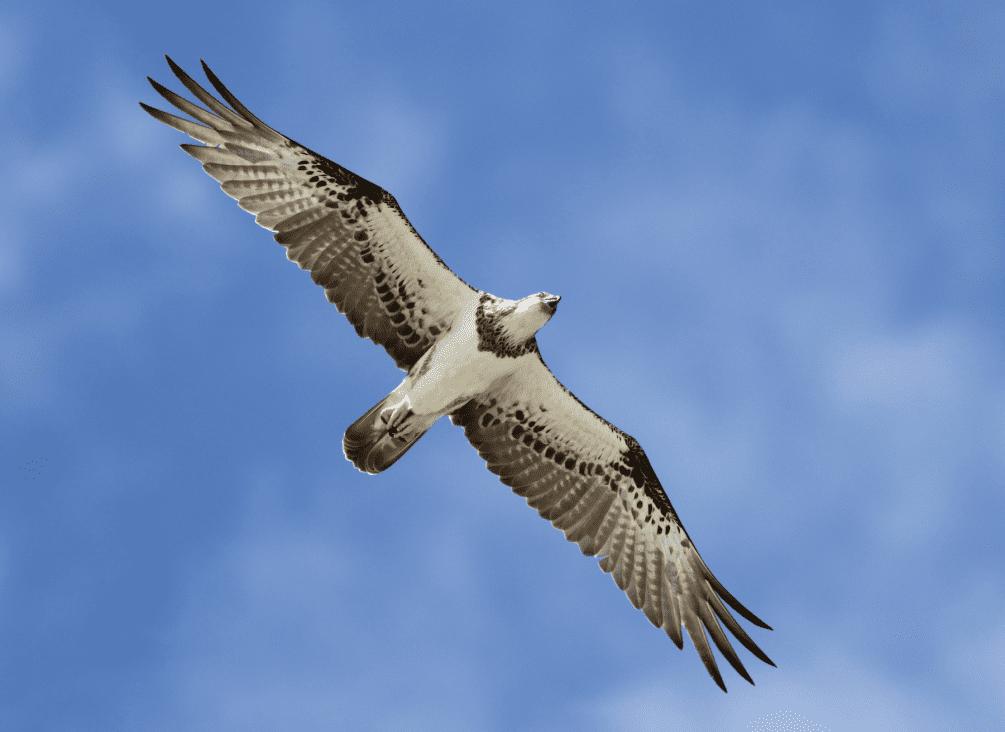

Osprey Total Return

Osprey is the first actively-managed, on-chain portfolio designed to offer returns that that aims to generate a target return above SOFR for loan providers.

Learn More